At Sager CPA, we often encounter clients who are unsure about the difference between tax planning and tax avoidance. These terms might sound similar, but they have distinct implications for your financial strategy and legal standing.

Understanding this difference is key to making informed decisions about your taxes and avoiding potential pitfalls. In this post, we’ll break down these concepts and help you navigate the complex world of tax management.

Tax planning is a strategic approach to manage finances with the goal of minimizing tax liability within legal bounds. It helps legally reduce taxable income, increase cash on hand and achieve long-term financial objectives. This process requires a deep understanding of tax laws, regulations, and available deductions and credits. Tax planning structures your finances to take full advantage of legal tax-saving opportunities.

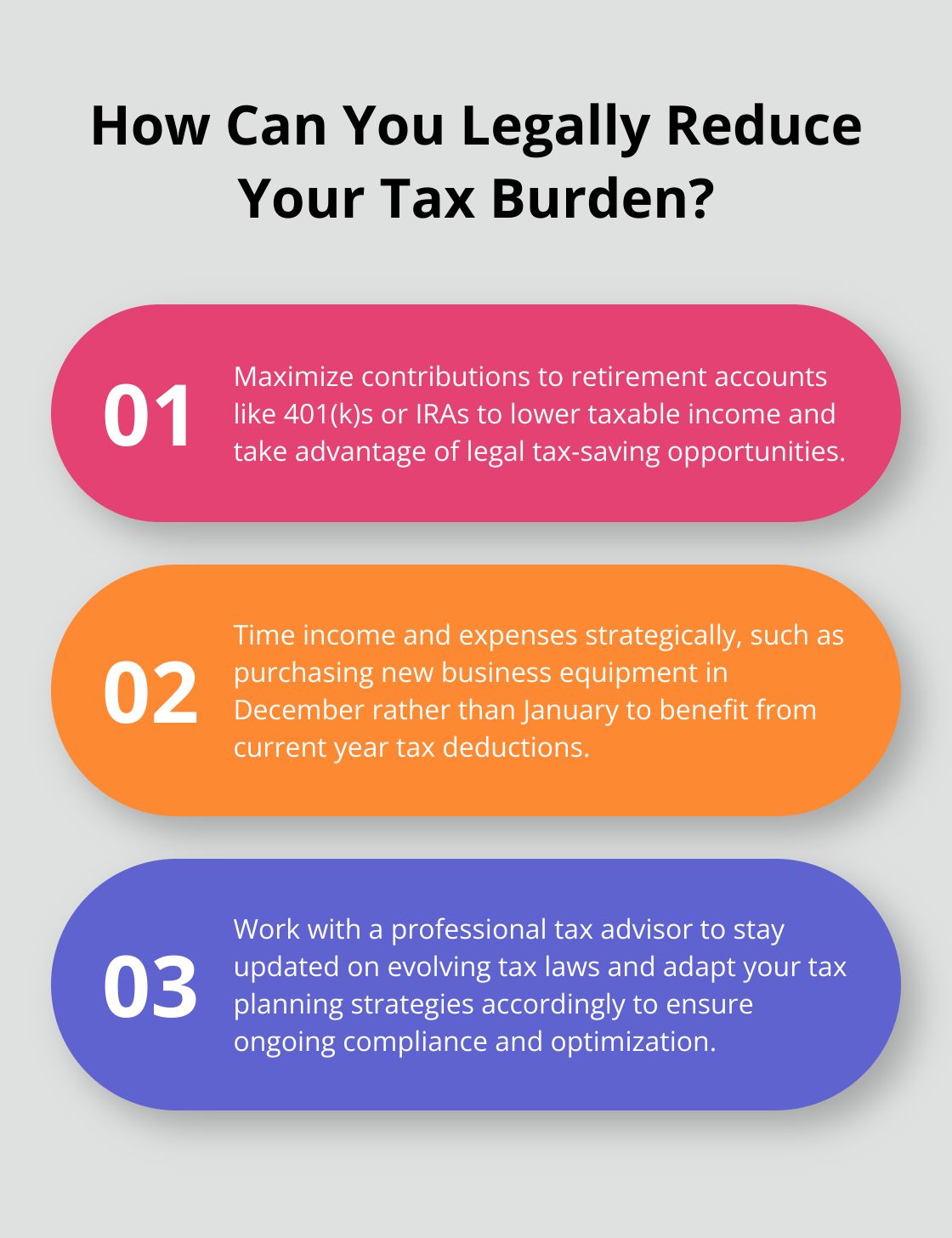

Numerous legal ways exist to minimize tax obligations. For individuals, this includes maximizing contributions to retirement accounts like 401(k)s or IRAs, which can lower taxable income. Businesses can time income and expenses strategically or take advantage of depreciation rules for assets.

Charitable giving provides another effective method. Donations to qualified organizations can provide tax deductions while supporting causes you care about. The key is to maintain proper documentation for all deductions and credits claimed.

Proactive tax planning offers significant benefits. It allows you to:

A business owner might decide to purchase new equipment in December rather than January to take advantage of current year tax deductions. An individual might realize that selling a highly appreciated asset this year could push them into a higher tax bracket, so they delay the sale until the following year.

Tax planning is not a one-time event but an ongoing process. As your financial situation changes and tax laws evolve, your tax planning strategies should adapt accordingly. Working with a professional tax advisor (like those at Sager CPA) can help ensure you always leverage the most current and effective tax-saving strategies.

Now that we’ve explored the concept of tax planning, let’s examine its counterpart: tax avoidance. Understanding the distinction between these two practices is crucial for maintaining financial health and legal compliance.

Tax avoidance refers to practices that push the boundaries of tax law to minimize tax liability. Unlike tax planning, which operates within clear legal parameters, tax avoidance often exploits loopholes or ambiguities in tax legislation. This approach can lead to significant financial and legal risks for individuals and businesses.

Tax law is complex and constantly evolving, which creates grey areas that some taxpayers attempt to exploit. For example, the use of offshore accounts in low-tax jurisdictions has been a common avoidance tactic. While not inherently illegal, these strategies often skirt the line between legal tax planning and illegal evasion.

A study revealed that tax avoidance costs governments worldwide significant amounts in lost revenue annually. This staggering figure highlights the scale of the issue and the potential consequences for public finances.

Engaging in tax avoidance can result in severe repercussions. The IRS has become increasingly sophisticated in detecting and challenging questionable tax practices. In recent years, the agency has collected billions in unpaid taxes from high-income taxpayers and large corporations through enforcement actions.

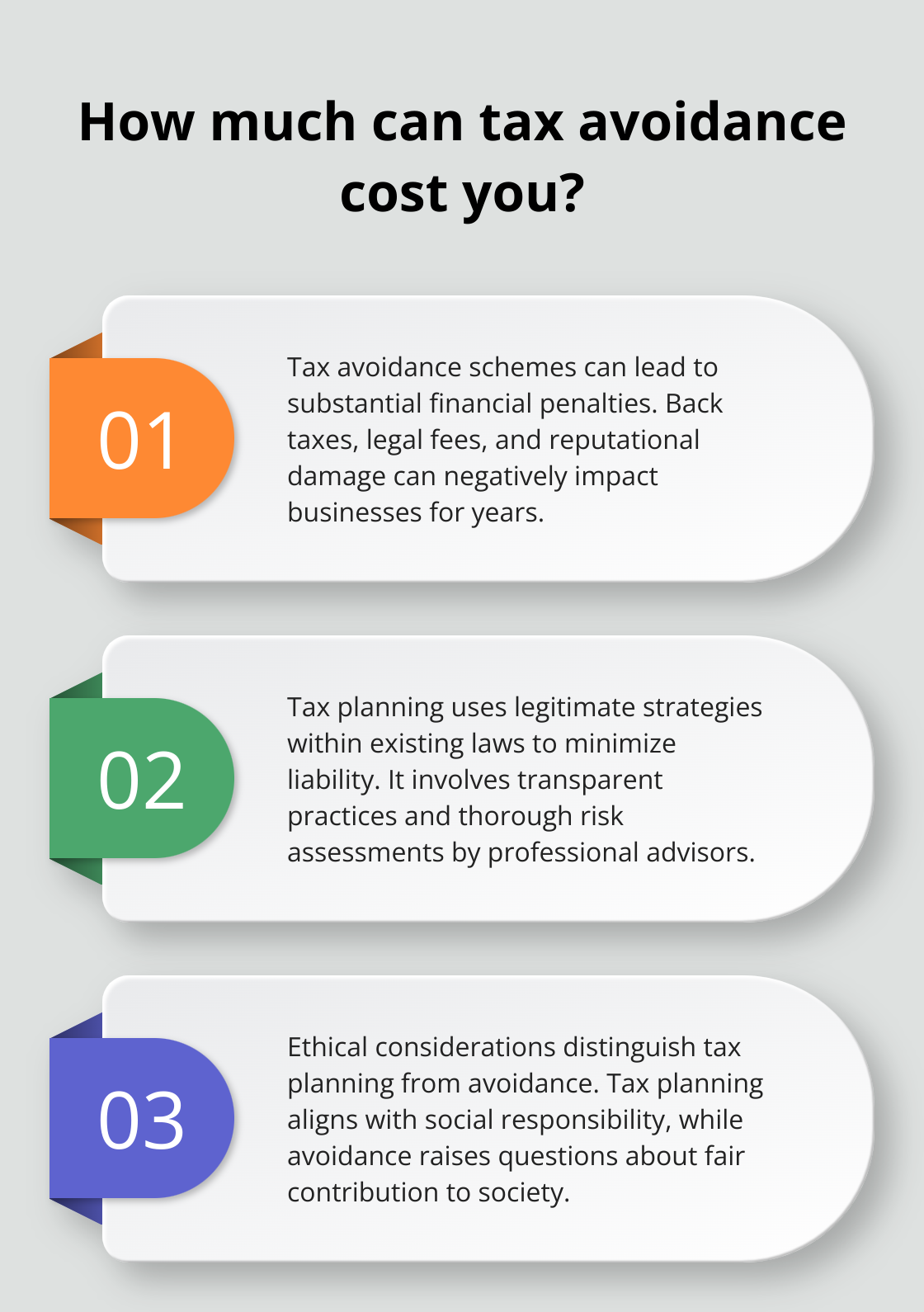

Financial penalties for tax avoidance can be substantial. In extreme cases, taxpayers may face criminal charges. Beyond legal consequences, there’s also reputational risk. Public exposure of aggressive tax avoidance strategies can damage a business’s or individual’s standing, potentially leading to loss of customers, investors, or business opportunities.

Navigating the complex landscape of tax law requires expert knowledge. We strongly advise against engaging in tax avoidance practices. Instead, we recommend focusing on legitimate tax planning strategies that align with both the letter and spirit of the law. Professional tax advisors (such as those at Sager CPA) stay up-to-date with the latest tax regulations to ensure their clients benefit from all legal tax-saving opportunities without crossing into risky territory.

Now that we’ve explored the concept of tax avoidance and its potential pitfalls, let’s examine the key differences between tax planning and tax avoidance in the next section. Understanding these distinctions will help you make informed decisions about your tax strategy and financial future.

Tax planning uses legitimate strategies within existing tax laws to minimize tax liability. It aligns with both the letter and spirit of the law.

Tax avoidance, however, often exploits loopholes or ambiguities in tax legislation. While not necessarily illegal, these practices push the boundaries of acceptability and can attract scrutiny from tax authorities. The IRS has improved its ability to identify and challenge questionable tax practices, which can lead to legal and financial consequences for those involved in avoidance schemes.

The level of transparency marks another key difference between these approaches. Tax planning is an open and honest process. When you work with a reputable tax advisor, they explain and document all strategies and their potential impacts clearly. There’s no need to hide anything because all actions taken fall within legal bounds.

Tax avoidance schemes, on the other hand, often rely on a lack of transparency. They may involve complex structures or transactions designed to obscure the true nature of financial activities. This opacity can raise red flags with tax authorities and lead to increased scrutiny or audits.

The long-term financial impacts of tax planning versus tax avoidance contrast sharply. Effective tax planning can lead to sustainable financial benefits over time. Consistent application of legal strategies to minimize tax liability allows individuals and businesses to improve their cash flow, increase savings, and invest more in growth opportunities.

In contrast, tax avoidance schemes may offer short-term gains but often come with significant long-term risks. If challenged by tax authorities, the costs can be substantial (including back taxes, penalties, and legal fees). Moreover, the reputational damage from association with aggressive tax avoidance can negatively affect business relationships and opportunities for years to come.

Tax planning involves a thorough assessment of risks and benefits. Professional tax advisors (such as those at Sager CPA) evaluate various legal strategies and their potential outcomes. They consider factors like changes in tax laws, economic conditions, and individual financial situations to create a robust, adaptable plan.

Tax avoidance often overlooks comprehensive risk assessment. The focus tends to be on immediate tax savings without fully considering potential future consequences. This short-sighted approach can lead to significant financial and legal troubles down the line.

Ethics play a significant role in distinguishing tax planning from tax avoidance. Tax planning aligns with ethical business practices and social responsibility. It recognizes the importance of contributing fairly to society while legally optimizing one’s financial position.

Tax avoidance, however, often raises ethical questions. It can be seen as exploiting the system unfairly, potentially at the expense of others who pay their full share of taxes. This ethical dimension extends beyond legal considerations and can impact public perception and corporate reputation.

The difference between tax planning and tax avoidance is clear. Tax planning offers a legal and ethical approach to optimize your tax position. Tax avoidance can lead to significant risks and consequences, which you should avoid.

Expert tax advisors provide invaluable knowledge to navigate complex tax regulations. They identify legitimate opportunities for tax savings and develop strategies tailored to your specific financial situation. Professional guidance ensures compliance with all relevant regulations.

Sager CPA specializes in expert financial management and tax planning services for individuals and businesses. We offer comprehensive tax planning strategies to legally reduce your tax liabilities. Our team works closely with clients to create personalized financial strategies that align with their goals and values.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.