Small business owners often struggle with tax planning, leaving money on the table. At Sager CPA, we’ve seen countless entrepreneurs miss out on valuable deductions and savings opportunities.

This guide will walk you through essential small business tax planning strategies to help you keep more of your hard-earned money. We’ll cover often-overlooked deductions, smart business structure choices, and timing tactics to minimize your tax burden.

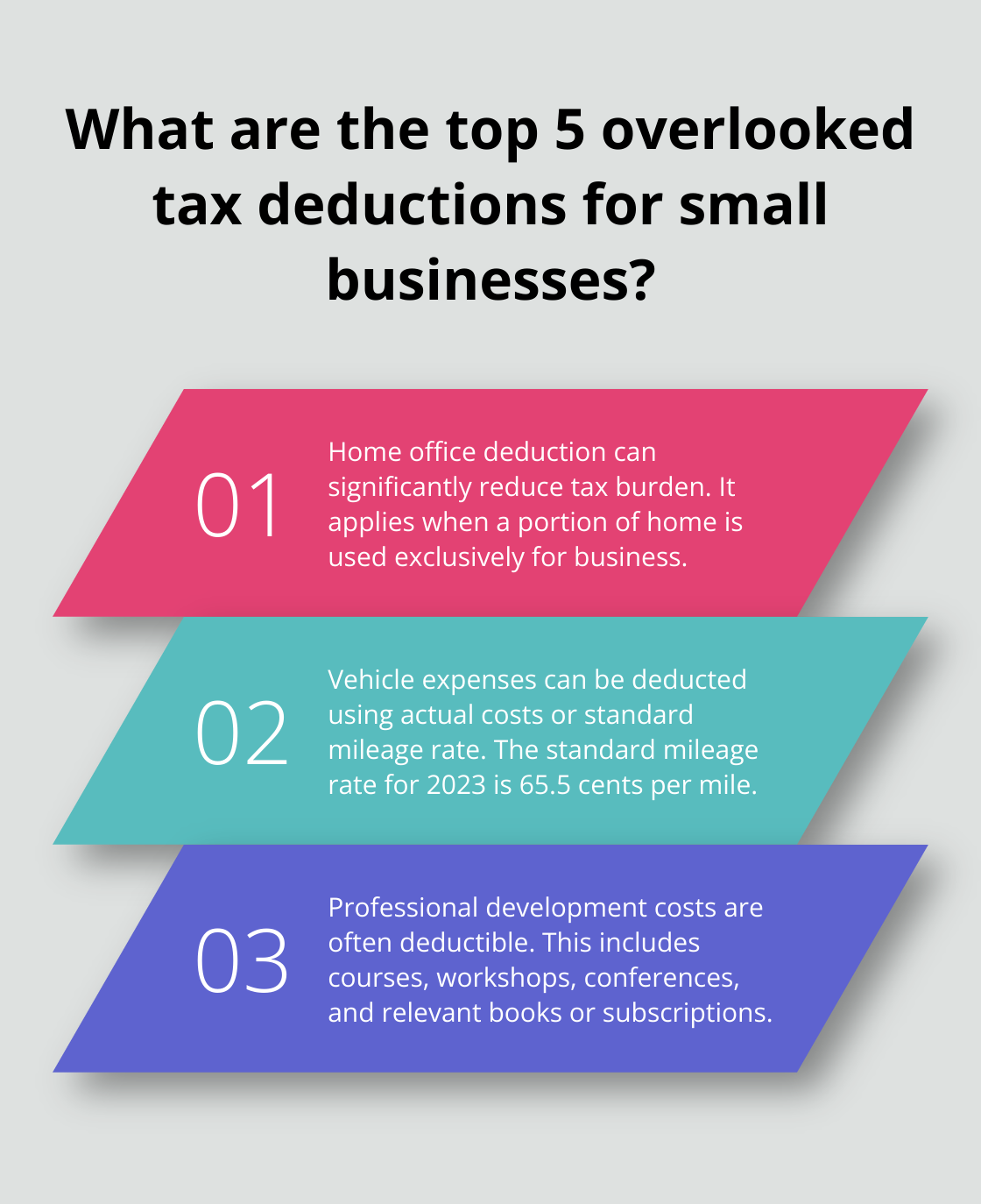

Small business owners often leave money on the table by overlooking valuable tax deductions. Let’s explore several common deductions that can significantly reduce your tax burden.

If you use a portion of your home exclusively for business, you may qualify for the home office deduction. This deduction provides information on returns filed and taxes collected, enforcement, taxpayer assistance, the IRS budget and workforce, and other selected activities.

Many small business owners underutilize vehicle-related deductions. You can either deduct actual expenses or use the standard mileage rate (65.5 cents per mile for 2023). Keep a detailed log of your business-related trips to maximize this deduction.

Expenses related to improving your business skills are often deductible. This includes courses, workshops, conferences, and even relevant books or subscriptions.

Different industries have unique deductions. For example, restaurants can deduct food spoilage, while construction companies might deduct equipment depreciation. It’s important to work with a tax professional familiar with your industry to identify these opportunities.

The IRS requires thorough documentation for all deductions. Maintain organized records of receipts, invoices, and bank statements. Consider using accounting software to streamline this process. A balance sheet will help you account for costs like employees and supplies. It will also help you track assets, liabilities, and equity.

Tax laws change frequently (what was deductible last year might not be this year). Stay up-to-date with the latest tax code changes to ensure you maximize your deductions while remaining compliant.

Now that we’ve covered often-overlooked deductions, let’s explore how your business structure can impact your tax benefits.

Selecting the right business structure significantly affects your tax obligations. This decision can make or break your tax strategy, so it’s essential to understand the implications of each option.

Sole proprietorships offer the most straightforward business structure, but they come with potential drawbacks. As a sole proprietor, you report business income on your personal tax return, which can push you into a higher tax bracket. Additionally, you bear personal liability for all business debts and obligations, including taxes.

Partnerships offer more flexibility in terms of management and profit-sharing. However, partners still bear personal liability for business debts and taxes. Each partner reports their share of business income on their individual tax returns, which can lead to higher personal tax rates.

LLCs provide liability protection while offering flexible tax treatment. Small businesses can benefit from the tax advantages and drawbacks of an LLC, depending on their specific circumstances.

S Corporations and C Corporations offer the strongest liability protection but come with more complex tax rules. S Corporations allow profits to pass through to shareholders, potentially reducing self-employment taxes. C Corporations face double taxation on profits, but they offer more options for fringe benefits and can benefit businesses planning to reinvest profits.

Changing your business structure can have significant tax implications. Your business structure determines which income tax return form you file. When considering a change, it’s important to take into account both legal and tax issues.

A professional tax advisor can help you navigate these complex decisions. They can analyze your specific financial situation, growth projections, and long-term goals to recommend the most tax-efficient structure for your business. The optimal choice today might not be the best option as your business evolves, so regular reassessment proves valuable.

Choosing the right business structure forms just one piece of the tax planning puzzle. Strategic timing of income and expenses can further reduce your tax burden, which we’ll explore in the next section.

Strategic timing of income, expenses, and investments can significantly impact your tax liability. We help numerous small businesses optimize their tax positions through careful planning and execution.

One effective strategy involves accelerating expenses into the current tax year while deferring income to the next. This approach can lower your taxable income for the current year. You might prepay some of next year’s expenses in December or delay sending out invoices until January.

This strategy doesn’t suit everyone. If you expect to be in a higher tax bracket next year, it might benefit you more to accelerate income and defer expenses. Always consider your projected future earnings when making these decisions.

The Section 179 deduction allows businesses to deduct the full purchase price of qualifying equipment and software purchased or financed during the tax year. For 2023, the deduction limit stands at $1,160,000. This can serve as a powerful tool for reducing your tax liability if you need to make major purchases.

Don’t fall into the trap of buying unnecessary equipment just for the tax deduction. Try to make strategic purchases that benefit your business long-term while also providing tax advantages.

If you plan to sell investments, consider the timing carefully. Long-term capital gains (from assets held for more than a year) typically incur lower tax rates than short-term gains. If possible, hold onto appreciating assets for at least a year before selling.

For investments that have lost value, selling before the end of the tax year can allow you to offset capital gains or even deduct up to $3,000 against your ordinary income.

Tax laws change frequently. What works this year might not serve as the best strategy next year. Work with a knowledgeable tax professional who can help you navigate these decisions and create a personalized tax strategy for your business.

At Sager CPA, we stay up-to-date with the latest tax laws and can help you implement these timing strategies effectively. Our goal focuses on ensuring you’re not just compliant, but that you’re taking full advantage of every opportunity to minimize your tax burden and maximize your business’s financial health.

Effective tax planning strategies for small businesses can significantly impact financial health. Understanding deductions, choosing the right structure, and timing income and expenses strategically reduce tax burdens. These approaches create a solid foundation for growth and success, not just save money.

Tax laws change frequently, and what works for one business might not suit another. Professional guidance from a Certified Public Accountant (CPA) who specializes in small business taxation provides personalized advice tailored to specific situations. Sager CPA offers expert financial management and tax planning services designed to help small businesses thrive.

We don’t just crunch numbers; we work closely with clients to understand their business goals and create customized action plans. Our team stays current with the latest tax laws and implements effective strategies to minimize tax liability while ensuring compliance. Schedule a consultation with us to take the first step towards optimizing your small business taxes and setting the stage for sustainable growth.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.