Small businesses face unique financial challenges that can make or break their success. At Sager CPA, we understand the critical role a top-notch accountant plays in navigating these complexities.

Finding the best CPA for small business isn’t just about crunching numbers; it’s about gaining a strategic partner who can propel your company forward. This post explores why investing in quality accounting services is essential for your small business’s growth and long-term prosperity.

A top-tier CPA transforms a small business’s financial landscape. Let’s explore the tangible ways expert accounting services can boost your company’s financial health and drive growth.

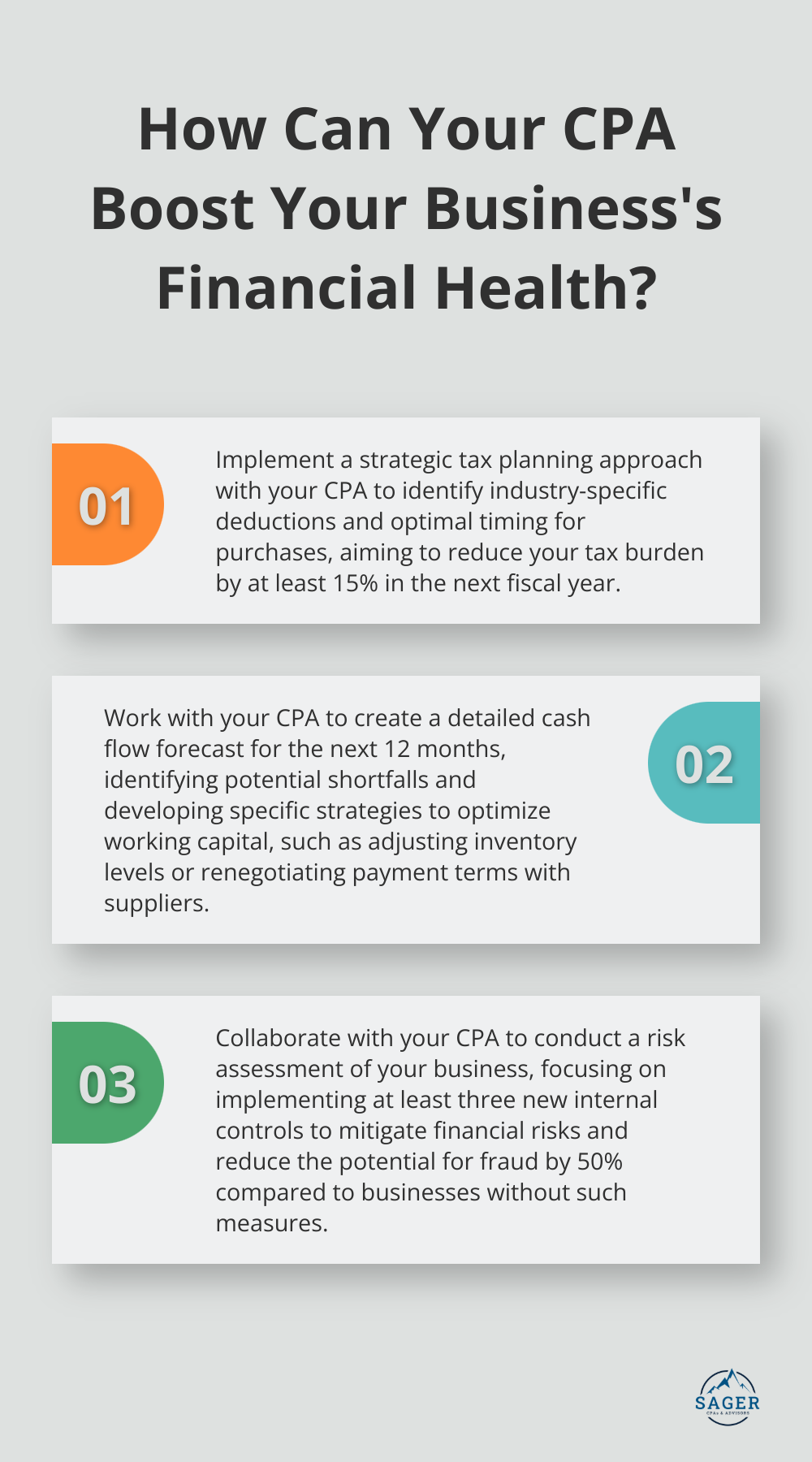

A skilled CPA doesn’t just file your taxes; they strategically plan to minimize your tax burden. The IRS provides general information about federal tax laws that apply to self-employed individuals and statutory employees. This guidance can help businesses understand their tax obligations and potential savings opportunities. It’s about using every legal opportunity to keep more money in your business.

CPAs identify often-overlooked deductions specific to your industry. They suggest optimal timing for certain purchases or investments to maximize tax benefits. These strategies lead to substantial savings that directly impact your bottom line.

Quality CPAs provide more than past performance analysis-they offer insights to shape your future. Financial forecasts and analysis help you identify growth opportunities and potential pitfalls before they occur.

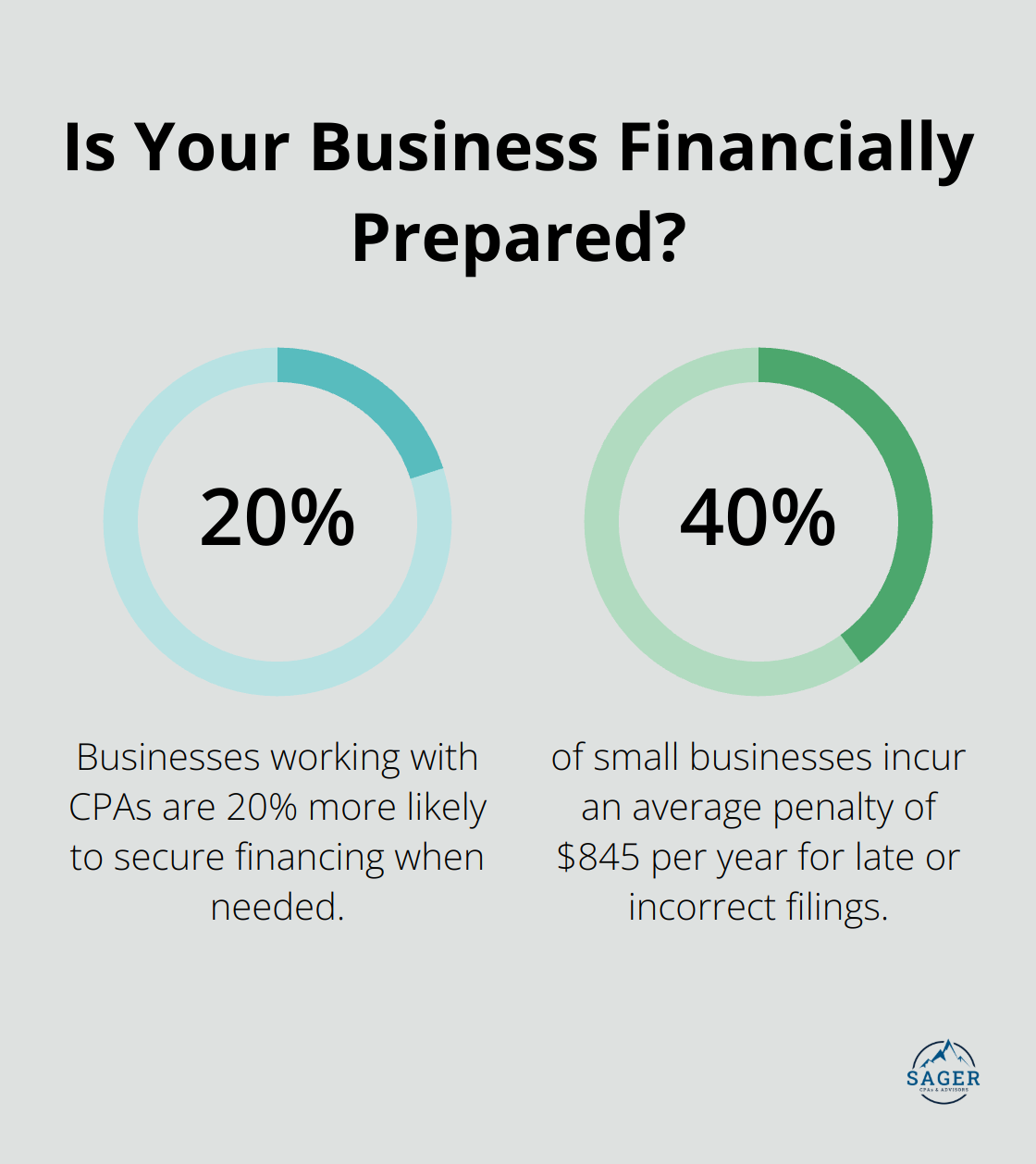

The American Institute of CPAs states that businesses working with CPAs are 20% more likely to secure financing when needed. This improved financial clarity allows you to make confident decisions about expansion, equipment purchases, or hiring new staff.

Accurate financial reporting isn’t just good practice-it’s essential for compliance and can save you from costly penalties. The IRS reports that 40% of small businesses incur an average penalty of $845 per year for late or incorrect filings. A proficient CPA ensures your financial statements are accurate and compliant, significantly reducing this risk.

Moreover, clean financial records prepared by a CPA can be beneficial in the event of an audit. However, it’s worth noting that professionally prepared forms may actually be more likely to be audited, as IRS computer software scans for known “red flags”.

A quality CPA becomes a strategic partner in your business’s financial planning. They help create comprehensive budgets, forecast cash flow, and develop long-term financial strategies. This proactive approach allows you to anticipate financial needs and opportunities, rather than simply reacting to them.

Different industries face unique financial challenges and opportunities. A top-notch CPA brings industry-specific knowledge to the table. They understand the nuances of your business sector, allowing them to provide tailored advice and strategies that generic accounting services might miss.

As we move forward, it’s clear that the expertise of a quality CPA is not just beneficial-it’s essential for small businesses aiming for sustainable growth and financial stability. The next section will explore how these financial experts help navigate the complex world of business regulations.

Small business owners face a daunting task when they attempt to navigate the intricate world of business regulations. Tax laws, financial reporting requirements, and business structures constantly evolve, which makes compliance challenging while trying to focus on core business operations.

Tax laws are notoriously complex and subject to frequent changes. The Tax Cuts and Jobs Act changed deductions, depreciation, expensing, tax credits and other things that affect businesses. A skilled CPA stays ahead of these changes, which ensures your business remains compliant while maximizing available tax benefits.

The prospect of an audit can unnerve any business owner. However, a CPA allows you to approach these situations with confidence. CPAs prepare and organize financial records in a way that streamlines the audit process, which potentially reduces its duration and stress.

The IRS provides information on returns filed and taxes collected, enforcement, taxpayer assistance, the IRS budget and workforce, and other selected activities.

Selecting the appropriate business structure impacts everything from taxes to personal liability. A CPA provides invaluable insights into the pros and cons of each option (sole proprietorship, partnership, LLC, or corporation).

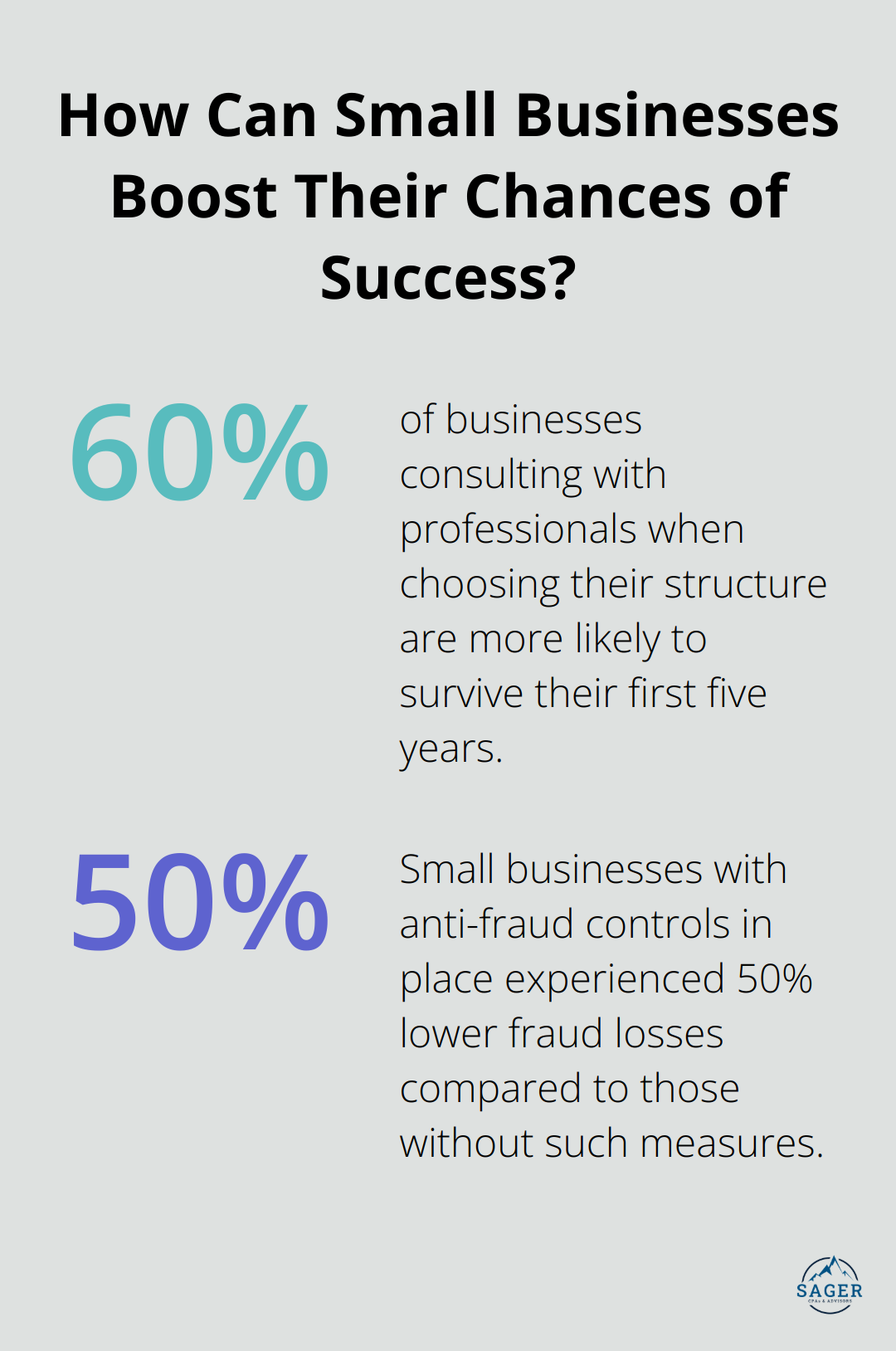

The Small Business Administration reports that businesses consulting with professionals when choosing their structure are 60% more likely to survive their first five years. This statistic underscores the long-term impact of making informed structural decisions from the outset.

Effective internal controls prevent fraud and ensure accurate financial reporting. The Association of Certified Fraud Examiners found that small businesses with anti-fraud controls in place experienced 50% lower fraud losses compared to those without such measures.

A CPA designs and implements these controls, tailoring them to your specific business needs and industry requirements. This proactive approach not only protects your assets but also enhances the credibility of your financial statements.

Different industries often face unique regulatory challenges. For example, healthcare providers must navigate HIPAA compliance, while e-commerce businesses need to understand sales tax obligations across multiple jurisdictions.

A CPA with industry-specific expertise guides you through these complex waters, ensuring compliance while identifying opportunities to optimize your financial practices within the regulatory framework.

The value of a CPA extends far beyond mere number-crunching. Their expertise in navigating complex regulations provides a solid foundation for your business. But a top-notch CPA offers even more – they become a strategic partner in your business growth and financial success.

A top-notch CPA does more than manage your books and file your taxes. They become an integral part of your business strategy, helping you navigate financial challenges and seize opportunities for growth. Let’s explore how a skilled CPA can propel your business forward.

A skilled CPA helps you create a comprehensive growth plan tailored to your business goals. This involves analysis of your current financial position, identification of key performance indicators, and setting of realistic targets for expansion. Having a business plan doubles the chances of success of a new venture.

CPAs work closely with clients to develop financial projections that account for various scenarios. This allows you to make informed decisions about investments, hiring, and market expansion. This proactive approach helps you stay ahead of the curve and capitalize on emerging opportunities in your industry.

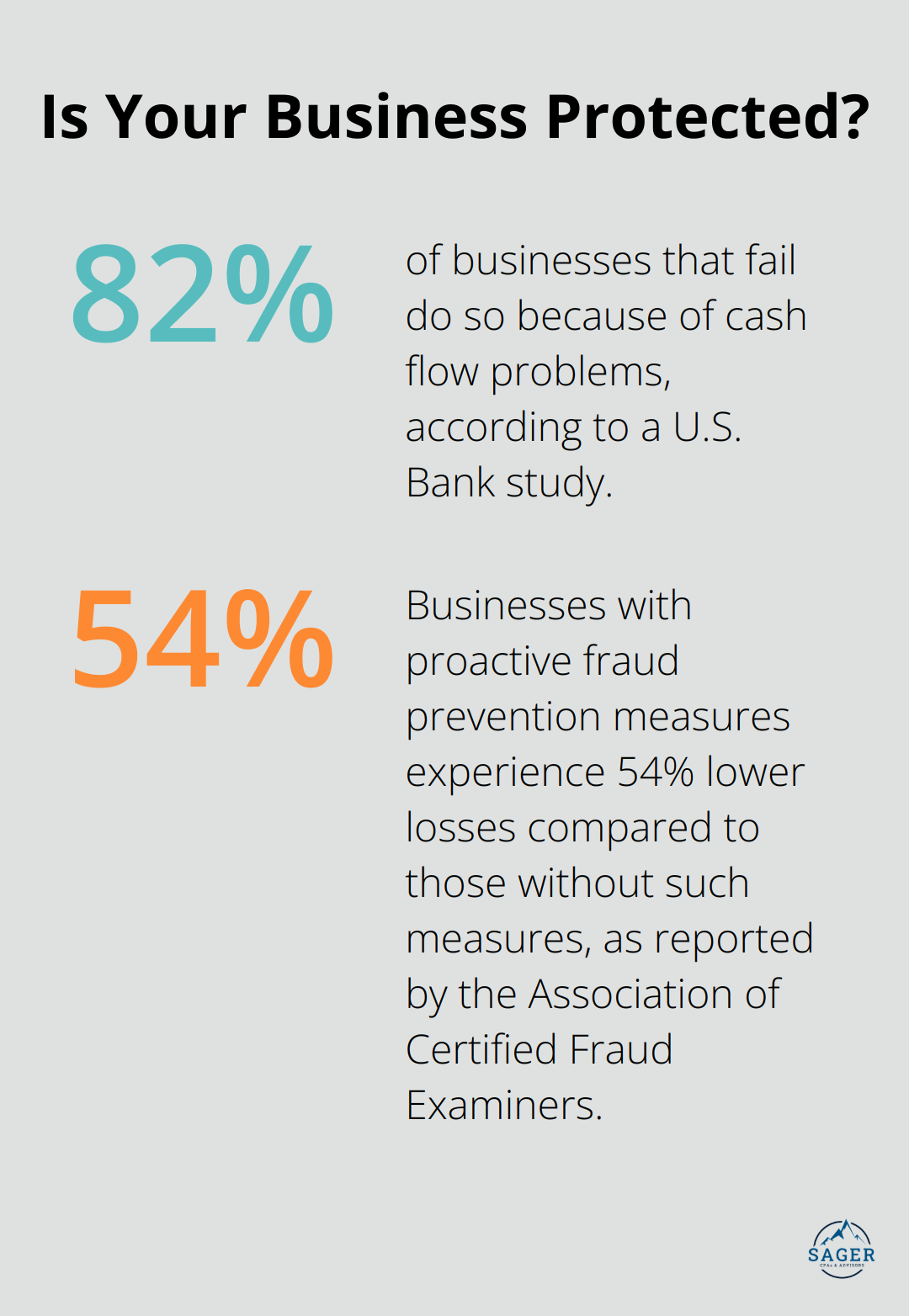

Cash flow is the lifeblood of any small business, and mismanagement can lead to serious problems. A U.S. Bank study found that a staggering 82% of businesses that fail do so because of cash flow problems. A CPA can help you implement effective cash flow strategies to ensure your business maintains a healthy financial position.

This includes creation of detailed cash flow forecasts, identification of potential shortfalls before they occur, and development of strategies to optimize your working capital. CPAs can also advise on inventory management, accounts receivable policies, and supplier negotiations to improve your cash position.

Every business faces financial risks, but a CPA can help you identify and mitigate these threats before they impact your bottom line. This involves conducting regular risk assessments, implementing internal controls, and developing contingency plans for various scenarios.

For example, a CPA can help you diversify your revenue streams to reduce dependence on a single customer or market. They can also advise on insurance coverage to protect against unforeseen events. The Association of Certified Fraud Examiners reports that businesses with proactive fraud prevention measures in place experience 54% lower losses compared to those without such measures.

Different industries face unique financial challenges and opportunities. A top-notch CPA brings industry-specific knowledge to the table. They understand the nuances of your business sector, allowing them to provide tailored advice and strategies that generic accounting services might miss.

This specialized expertise can be particularly valuable when it comes to industry-specific regulations, tax incentives, and financial best practices. A CPA with experience in your field can help you navigate these complexities more effectively (and potentially save you money in the process).

A skilled CPA often has a network of professional contacts that can benefit your business. They can introduce you to potential partners, investors, or other professionals who can contribute to your growth strategy.

These connections can open doors to new opportunities, provide valuable insights, and help you build a stronger support network for your business. A CPA’s role as a trusted advisor often extends beyond financial matters, making them a valuable asset in your overall business strategy.

A top-notch CPA transforms small businesses through strategic financial guidance and expert tax planning. The best CPA for small business provides more than basic bookkeeping; they offer comprehensive financial management that drives growth and stability. Professional financial advice empowers business owners to make informed decisions, seize opportunities, and navigate market changes effectively.

At Sager CPA and Advisors, we specialize in tailored financial services for individuals and businesses. Our proactive strategies and customized action plans enhance financial clarity and position your business for success. We commit to aligning our expertise with your unique business goals and vision.

Don’t let financial complexities hinder your business growth. Schedule a consultation with Sager CPA to create a personalized financial strategy that sets your business on the path to long-term prosperity. Your small business deserves top-notch CPA services to thrive in today’s competitive landscape.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.