Investment planning is complicated by tax concerns, often more than investors realize. The intricate web of tax implications can significantly impact returns and overall financial strategies.

At Sager CPA, we’ve seen how overlooking tax considerations can lead to costly mistakes in investment planning. This post will explore the key tax issues that affect various investment vehicles and provide strategies for more tax-efficient investing.

When you invest in stocks, you face more than just capital gains taxes. Dividends also affect your tax situation. Qualified dividends are taxed at the same rates as the capital gains tax rate, which are lower than ordinary income tax rates. Non-qualified dividends are taxed as ordinary income. In 2024, long-term capital gains rates range from 0% to 20% (depending on your income). Short-term gains, however, attract ordinary income tax rates, which can reach up to 37%.

Bond investments generate interest income, which is typically subject to ordinary income tax rates. Municipal bonds offer a tax advantage: their interest is often exempt from federal taxes and sometimes state taxes. Treasury bonds, while subject to federal taxes, are exempt from state and local taxes. This can significantly impact your after-tax returns, especially if you’re a high-income investor in a state with high tax rates.

Real estate investments involve various tax considerations. Property taxes are an ongoing expense, but you can generally deduct them on federal tax returns. Rental income is taxable, but you can offset it with expenses like mortgage interest, property management fees, and depreciation. The 1031 exchange allows taxpayers holding real property for investment purposes to defer capital gains tax that would otherwise be recognized upon the sale of the property.

Mutual funds and ETFs require careful consideration from a tax perspective. These funds often distribute capital gains to shareholders, which can result in unexpected tax bills (even if you haven’t sold your shares). ETFs generally offer more tax efficiency due to their structure, but this isn’t guaranteed. Some mutual funds are specifically designed to be tax-efficient, which can benefit taxable accounts.

Understanding these tax implications is essential for maximizing your investment returns. The next section will explore strategies you can use to invest more tax-efficiently and potentially reduce your overall tax burden.

Investing wisely requires more than selecting the right stocks or bonds; it demands a strategic approach to minimize your tax burden. Let’s explore practical methods to retain more of your investment gains.

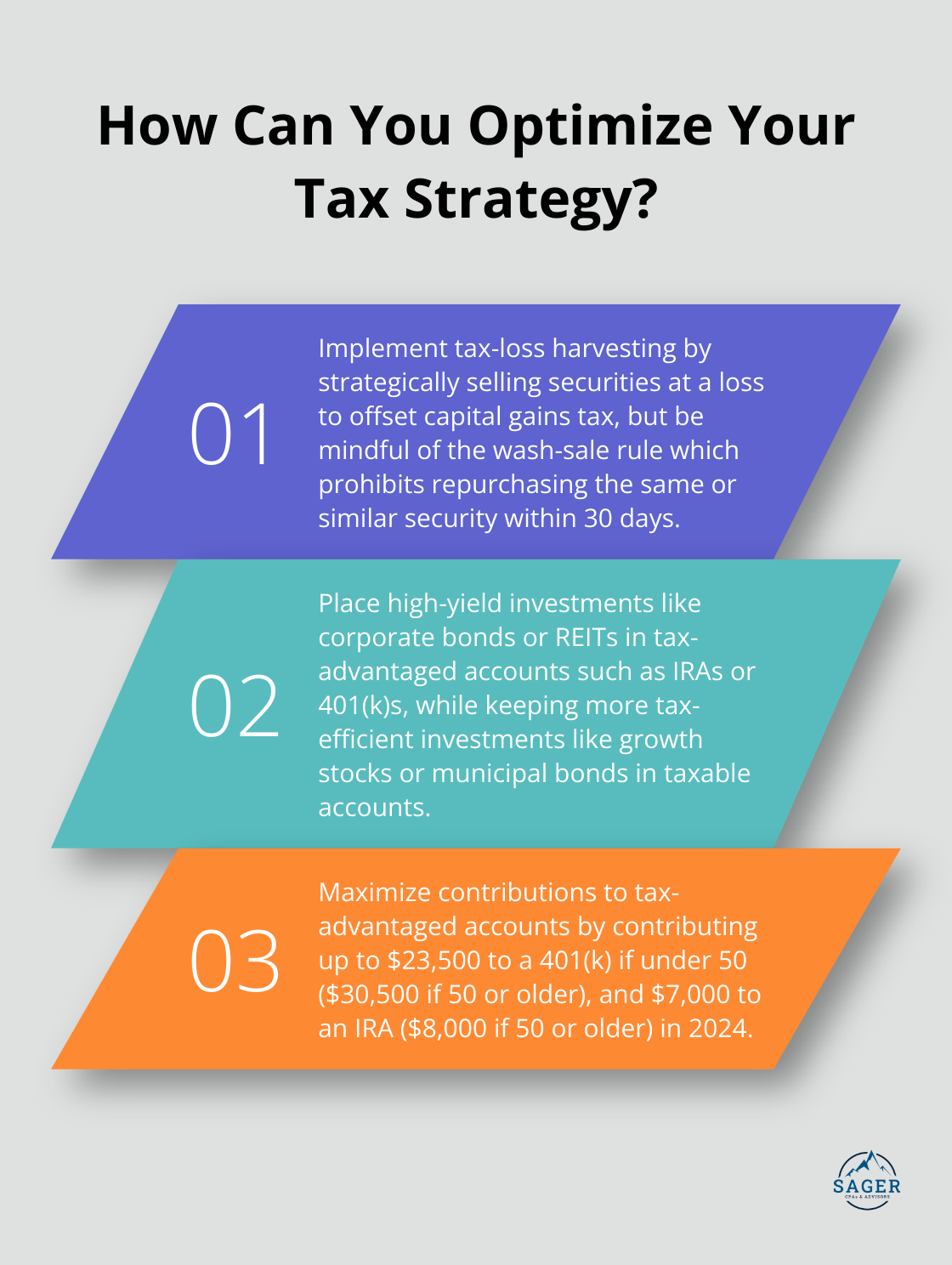

Tax-loss harvesting is the timely selling of securities at a loss to offset the amount of capital gains tax owed from selling profitable assets. This strategy can be a powerful tool in your investment arsenal. However, be mindful of the wash-sale rule: you must not repurchase the same or a “substantially identical” security within 30 days before or after the sale.

Asset location plays a critical role in tax efficiency. High-yield investments that generate regular taxable income (such as corporate bonds or REITs) often fit better in tax-advantaged accounts like IRAs or 401(k)s. Conversely, growth stocks or municipal bonds, which tend to be more tax-efficient, can reside in taxable accounts. This strategy can potentially save you thousands in taxes over the long term.

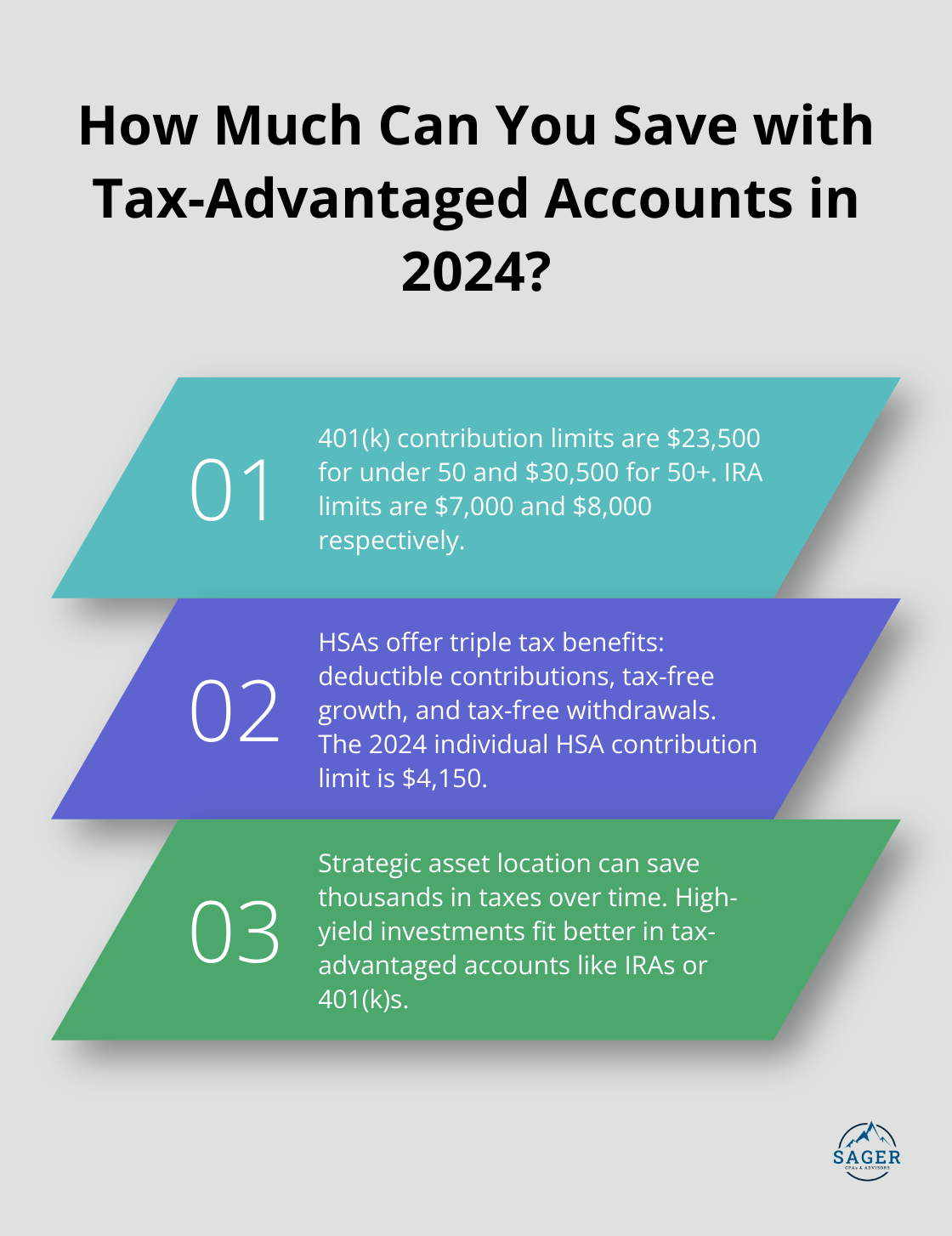

The power of tax-advantaged accounts should not be underestimated. In 2024, you can contribute up to $23,500 to a 401(k) if you’re under 50, and $30,500 if you’re 50 or older. For IRAs, the limits stand at $7,000 and $8,000, respectively. Health Savings Accounts (HSAs) offer triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses. In 2024, the individual HSA contribution limit is $4,150.

The timing of your investment decisions can significantly impact your tax obligations. Hold investments for more than a year before selling to qualify for lower long-term capital gains rates. Additionally, assess whether you’ll be in a lower tax bracket next year before considering the sale of a winning investment. If so, a delay in the sale could result in a lower tax bill.

While these strategies prove effective, they should always form part of a broader investment plan tailored to your specific financial situation and goals. Many investors find value in professional guidance to navigate these complex waters. As we move forward, let’s examine how to handle more intricate tax scenarios that can arise in investment planning.

Investment planning becomes more intricate as portfolios grow and diversify. Complex tax scenarios can significantly impact returns. This chapter explores these challenges and provides strategies to navigate them effectively.

The Alternative Minimum Tax (AMT) can surprise high-income investors. This parallel tax system ensures that taxpayers with substantial income pay at least a minimum amount of tax. The AMT exemption eventually phases out at 25 cents per dollar earned once certain income thresholds are reached. Investors approaching these thresholds should reassess their investment strategy.

Certain investments, like private activity municipal bonds, can trigger AMT liability. To mitigate this risk, investors should consider AMT-free municipal bonds or other tax-efficient investments. The timing of incentive stock option exercises can also help manage AMT exposure.

The Net Investment Income Tax (NIIT) adds complexity for high-income investors. This 3.8% tax applies to certain net investment income of individuals, estates, and trusts that have income above the statutory threshold amounts.

To minimize NIIT impact, investors should consider growth stocks that don’t pay dividends or municipal bonds that generate tax-exempt interest. Roth IRA conversions can also prove beneficial, as qualified distributions from Roth accounts are not subject to NIIT.

Global investments diversify portfolios but complicate tax situations. Foreign investments often incur withholding taxes on dividends and interest. The U.S. offers a foreign tax credit to avoid double taxation, but claiming this credit requires meticulous documentation.

For substantial foreign investments, specific foreign stock funds designed for tax efficiency can be advantageous. These funds often employ strategies to maximize the use of foreign tax credits. Investors should maintain detailed records of foreign taxes paid to ensure full credit claims.

The impact of state and local taxes on investment returns should not be overlooked. Tax rates vary significantly across states (with some having no income tax and others imposing rates over 10%). Residents of high-tax states should consider allocating a larger portion of their portfolio to tax-exempt municipal bonds from their home state.

Investors in high-tax states might explore the possibility of establishing residency in a more tax-friendly state. However, this decision requires careful consideration of all aspects of financial and personal life.

Navigating these complex tax scenarios often requires professional assistance. Expert tax advisors (like those at Sager CPA) can help optimize investment strategies to minimize tax burdens while maximizing returns. Effective tax planning is an ongoing process that requires regular review and adjustment as tax laws and financial situations evolve.

Investment planning is complicated by tax concerns, which emphasizes the need for a comprehensive approach. We explored various tax implications across different investment vehicles and strategies for tax-efficient investing. Our examination of complex scenarios like the Alternative Minimum Tax and international investment considerations further highlights the intricacies involved.

The complex nature of these tax concerns underscores the importance of professional guidance in investment planning. At Sager CPA, we offer expert financial management and tax planning services tailored for individuals and businesses. Our team provides strategic advice to help you make informed decisions and reduce tax liabilities.

Tax optimization should complement, not dictate, your investment decisions. A well-crafted investment strategy must align with your risk tolerance, time horizon, and financial objectives. Regular review and adjustment of your investment strategy, in consultation with financial professionals, will help you navigate the tax landscape more effectively and work towards maximizing your after-tax returns.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.