At Sager CPA, we know that proactive tax planning is the key to financial success. It’s not just about filing your taxes once a year; it’s about strategically managing your finances year-round to minimize tax liability and maximize savings.

In this post, we’ll explore effective strategies and tools for implementing proactive tax planning in your personal and business finances. Get ready to take control of your tax situation and potentially keep more money in your pocket.

Proactive tax planning is a strategic approach to manage finances with the goal of minimizing tax liabilities and maximizing savings. This practice can lead to significant financial benefits for both individuals and businesses.

Unlike reactive tax strategies that focus on dealing with tax issues after they arise, proactive planning anticipates potential tax implications throughout the year. This forward-thinking approach allows you to make informed decisions about your finances well before tax season arrives.

For example, a business owner might choose to purchase new equipment in December rather than January to take advantage of current-year tax deductions. Similarly, an individual might decide to accelerate charitable donations or defer income to optimize their tax situation.

The benefits of proactive tax planning are substantial and quantifiable. Knowledge sharing between audit and tax teams is an important factor in improving the client’s audit and tax outcomes.

Effective proactive tax planning requires a year-round commitment. This means you should regularly review your financial situation, stay informed about tax law changes, and adjust your strategies accordingly. For instance, the upcoming “2025 Tax Cliff” could bring substantial financial changes as key provisions of the 2017 Tax Cuts and Jobs Act expire.

One size doesn’t fit all when it comes to tax planning. What works for a small business owner may not be suitable for a high-net-worth individual. That’s why tax professionals develop customized tax planning strategies that align with each client’s unique financial situation and goals.

While reducing tax liability is a primary goal, proactive tax planning offers additional benefits. It can improve cash flow management, enhance financial decision-making, and provide a clearer picture of your overall financial health. For businesses, it can also lead to more accurate financial forecasting and budgeting.

Now that we understand what proactive tax planning is and why it’s important, let’s explore the key strategies you can implement to make the most of this approach.

Proactive tax planning requires consistent effort and attention throughout the year. Several key strategies can significantly impact your tax situation and overall financial health.

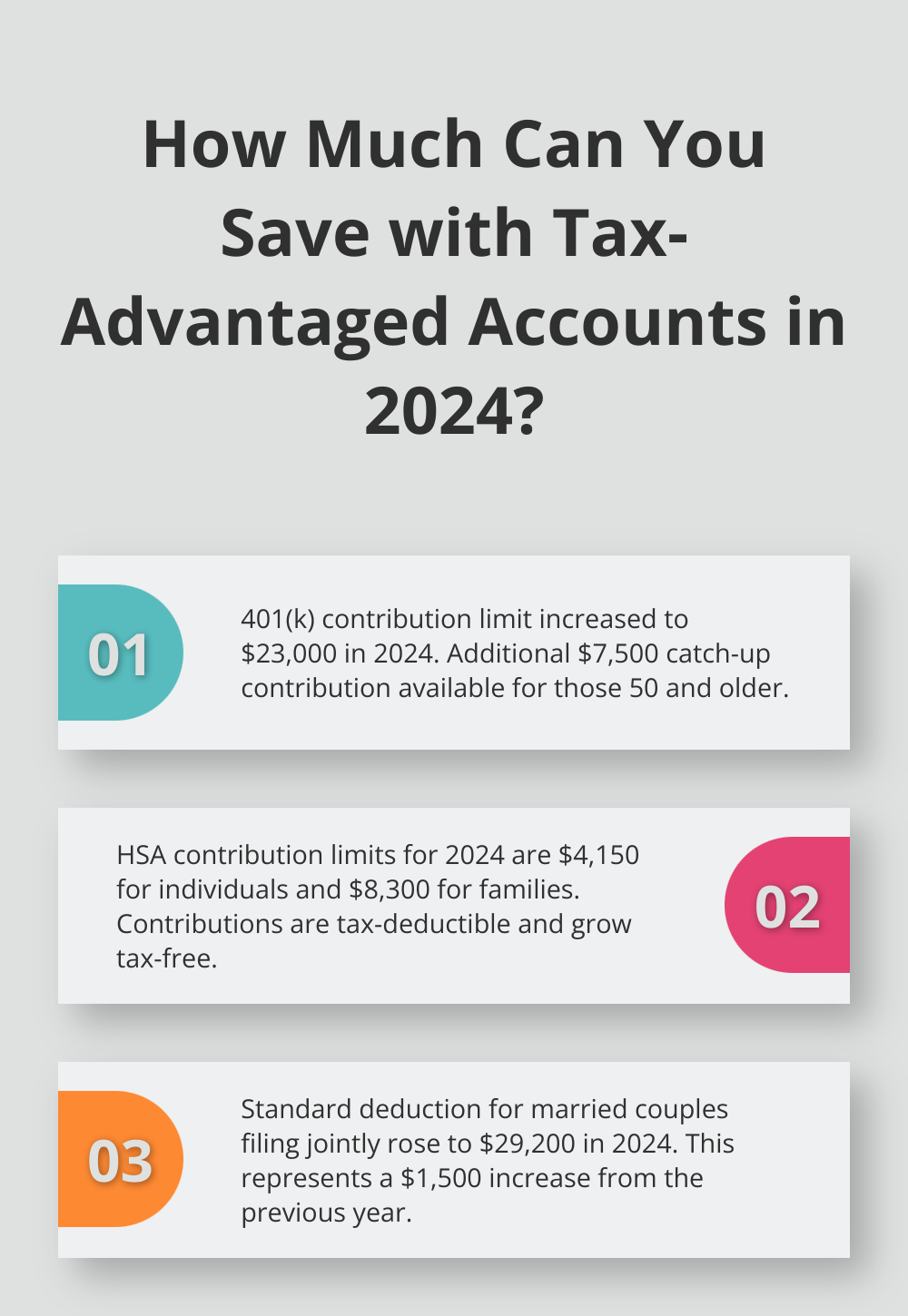

Staying informed about tax laws and regulations is essential. The tax landscape changes constantly, and awareness of these changes enables timely decisions. For example, the IRS adjusts tax brackets and standard deduction amounts annually. In 2024, the standard deduction for married couples filing jointly increased to $29,200 (up $1,500 from the previous year). Early knowledge of such information allows for more effective deduction planning.

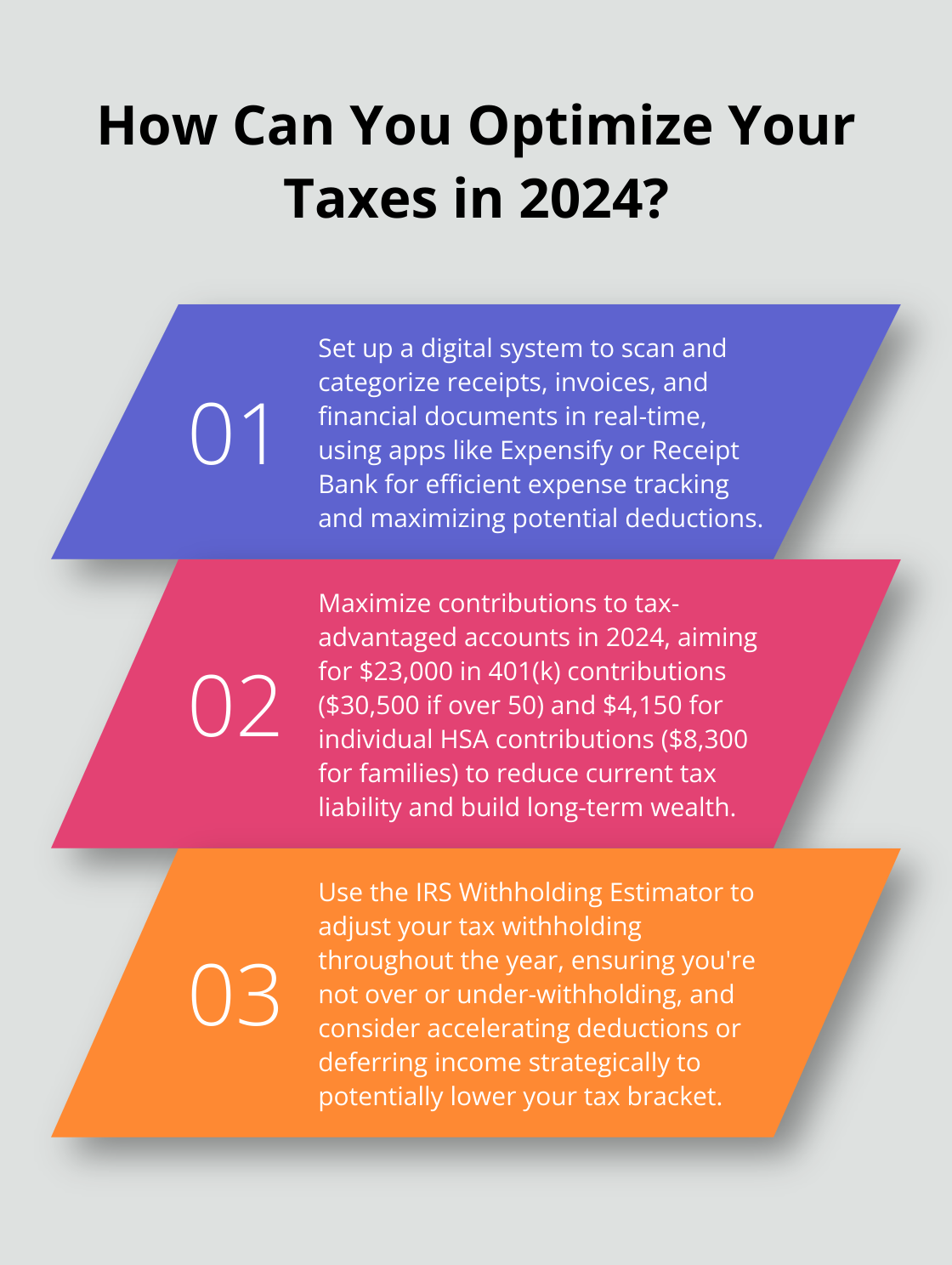

Meticulous record-keeping throughout the year is equally important. Create a system to organize receipts, invoices, and other financial documents. This approach not only simplifies tax preparation but also ensures you don’t miss potential deductions. Digital tools can scan and categorize receipts, making it easier to track expenses in real-time.

The timing of income and expenses can significantly impact tax liability. High-income earners might benefit from deferring income to the following tax year or accelerating deductions into the current year to potentially lower their tax bracket. However, this strategy requires careful consideration of overall financial situations and future income projections.

For business owners, the Section 179 deduction allows for immediate expensing of certain business equipment purchases. In 2024, the deduction limit is $1,220,000, with a spending cap of $3,050,000. Planning major purchases with these limits in mind can provide substantial tax savings.

Tax-advantaged accounts offer a powerful way to reduce taxable income and build long-term wealth. For 2024, the contribution limit for 401(k) plans increased to $23,000 (with an additional $7,500 catch-up contribution for those 50 and older). Maximizing these contributions not only reduces current tax liability but also sets the stage for a more secure retirement.

Health Savings Accounts (HSAs) present another opportunity for tax savings. In 2024, individuals can contribute up to $4,150, and families can contribute up to $8,300. These contributions are tax-deductible, grow tax-free, and can be withdrawn tax-free for qualified medical expenses.

For business owners, the choice of business structure can have significant tax implications. Each structure – sole proprietorship, partnership, LLC, S corporation, or C corporation – has its own tax treatment. Regular reviews of business structure with a tax advisor ensure the most tax-efficient option for each unique situation.

S corporations can provide tax savings through the ability to pay a reasonable salary and take additional income as distributions, potentially reducing self-employment taxes. However, this strategy requires careful planning and documentation to comply with IRS regulations.

The implementation of these strategies demands a comprehensive understanding of tax laws and individual financial situations. While this guide provides a starting point, collaboration with a professional tax advisor can lead to the development of a tailored plan that maximizes tax savings and supports long-term financial goals. As we move forward, let’s explore the tools and resources available to support your proactive tax planning efforts.

Technology plays a significant role in effective tax planning. The right tools can streamline processes and enhance decision-making. This chapter explores some of the most impactful technological resources available for proactive tax planning.

Tax planning software has transformed the way individuals and businesses approach their tax strategies. These tools often provide real-time tax liability calculations, allowing users to see the immediate impact of financial decisions. For example, the Bloomberg BNI Tax Planner is a comprehensive tool designed for complex, value-added tax planning services. It allows professionals to create and compare different scenarios, making it easier to choose the most beneficial approach.

While these tools are powerful, they work best when used in conjunction with professional advice to ensure accuracy and compliance.

Mobile apps have made expense tracking more accessible. Apps like Expensify and Receipt Bank allow you to capture receipts on the go, categorize expenses, and generate reports. This real-time tracking not only saves time during tax season but also provides a clearer picture of your financial situation throughout the year.

For business owners, QuickBooks Online offers a mobile app that syncs with the desktop version, allowing for seamless expense management and financial reporting. This integration can be particularly useful when working with your tax advisor, as it provides a comprehensive view of your business finances.

The IRS website offers a wealth of free tools and resources that can aid in tax planning. The IRS Withholding Estimator is a valuable tool for employees to ensure they’re withholding the right amount of tax from their paychecks. This publication explains both the withholding and estimated tax methods, as well as how to take credit on your return for the tax that was withheld and for your estimated tax payments.

For small business owners, the IRS’s Small Business and Self-Employed Tax Center provides targeted resources, including a virtual workshop series on tax responsibilities. These resources can help you stay informed about tax obligations and potential deductions specific to your business structure.

While technological tools are incredibly useful, they should complement rather than replace professional tax advice. Tax professionals (such as those at Sager CPA) often use these resources in conjunction with their expertise to develop comprehensive tax strategies for their clients.

The combination of technological resources and professional guidance ensures you’re making the most informed decisions for your financial future. Try to leverage these tools actively in your tax planning process, but always consult with a qualified tax advisor (like Sager CPA) for personalized strategies and expert insights.

Proactive tax planning empowers individuals and businesses to optimize their financial well-being. This approach minimizes tax liabilities, maximizes savings, and aligns with long-term financial goals. The strategies we discussed provide a solid foundation for effective tax management throughout the year.

Every financial situation requires a unique approach to tax planning. Consistent effort and attention to changing tax laws and regulations will position you for greater financial success. Technology can streamline the process, but it should complement rather than replace professional advice.

We at Sager CPA specialize in expert financial management and tax planning services for individuals and businesses. Our team can help you navigate the complexities of tax planning and develop customized strategies to optimize your tax situation. Take control of your financial future by implementing proactive tax planning strategies today.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.