At Sager CPA, we know that proactive tax planning is the key to financial success. It’s about staying ahead of the curve, not just reacting to tax events as they happen.

Proactive tax planning can save you money, reduce stress, and help you make smarter financial decisions year-round. In this post, we’ll show you how to implement effective strategies that can transform your approach to taxes.

Tax planning is a proactive financial practice that helps individuals and businesses manage their taxes and make smart financial decisions. This approach involves continuous monitoring and adjustment of financial decisions to optimize tax outcomes. Unlike reactive strategies that address taxes only during filing season, proactive planning takes a year-round perspective.

Many taxpayers fall into the trap of reactive tax planning. They scramble to gather documents and make last-minute decisions as the tax deadline approaches. This method often results in missed opportunities and higher tax bills. Proactive planning, however, involves regular check-ins with your financial situation and tax implications. For instance, instead of waiting until April to discover an overpayment in taxes, you could adjust your withholdings earlier in the year to increase your take-home pay.

The financial benefits of proactive tax planning are substantial. A study by the Government Accountability Office found that in recent years, about 70 percent of taxpayers have claimed the standard deduction. Implementation of proactive strategies allows you to keep more of your money working for you throughout the year.

Proactive tax planning extends beyond the current year’s taxes; it sets the foundation for long-term financial success. Strategic timing of capital gains or losses realization can significantly impact your tax liability.

Proactive tax planning reduces the stress associated with tax season. It ensures consistent compliance with tax laws, which is important considering the potential penalties for non-compliance. Staying ahead of your tax obligations helps you avoid the rush and potential errors that come with last-minute filing.

Implementation of proactive tax planning requires commitment and often professional guidance. Clients who adopt a proactive approach to tax planning often experience significant savings and a more secure financial future. The next section will explore key strategies to effectively implement proactive tax planning in your financial routine.

Proactive tax planning requires consistent attention to your financial situation. Regular reviews of income, expenses, and potential tax liabilities throughout the year allow for timely adjustments to withholdings or estimated tax payments. This practice prevents surprises during tax season.

For instance, a significant bonus or increase in investment income might necessitate increased withholdings or an additional estimated tax payment to avoid underpayment penalties. Conversely, a reduction in income or substantial charitable contributions could allow for reduced withholdings and increased cash flow.

The strategic timing of income recognition and expense realization can help manage your tax bracket and potentially reduce overall tax liability. This approach requires careful planning and consideration of your complete financial picture.

Self-employed individuals or those with control over client billing might consider deferring income to the following year if they expect to be in a lower tax bracket. Similarly, planning major business expenses in the current year could be beneficial if a higher tax bracket is anticipated. The goal is to pay taxes at the most advantageous time, not just defer them.

Utilizing tax-advantaged investment vehicles forms a critical component of proactive tax planning. These accounts (such as 401(k)s, IRAs, and Health Savings Accounts) offer significant tax benefits that can reduce current tax liability and help build long-term wealth.

For 2025, the contribution limit for 401(k) plans stands at $23,500, up from $23,000 in 2024. Maximizing these contributions can significantly reduce taxable income. Health Savings Accounts (HSAs) provide triple tax benefits: tax-deductible contributions, tax-free growth, and tax-free withdrawals for qualified medical expenses (if eligible).

For business owners, choosing the right business structure can have significant tax implications. Each structure (sole proprietorship, partnership, LLC, S-corporation, C-corporation) has its own tax rules and benefits. Regularly reviewing your business structure ensures it aligns with your current financial situation and long-term goals.

A thorough understanding of available tax credits and deductions can lead to substantial tax savings. These can include credits for energy-efficient home improvements, education expenses, or child and dependent care. Deductions might cover mortgage interest, charitable donations, or business expenses. Staying informed about changes in tax laws helps maximize these opportunities.

The implementation of these strategies demands a comprehensive understanding of tax laws and personal financial situations. Professional guidance can help develop tailored tax planning strategies that align with specific financial goals and circumstances. The next section will explore the tools and resources available to support effective tax planning efforts.

Tax planning software has transformed tax strategies. Tax Planner Pro changes all that, with a simple interface, easy to understand guides, and professional tools to save you time and make more money. Professional-grade software (Drake Tax or UltraTax CS) offers deeper analysis capabilities for complex situations.

These advanced platforms run multiple scenarios to visualize the impact of financial decisions on tax liability. You can quickly see how increasing 401(k) contributions might affect your taxable income and overall tax burden.

Mobile apps also play a significant role. Expense tracking apps (Expensify or MileIQ) automatically log business expenses and mileage, ensuring you capture all valuable deductions. The IRS2Go app provides direct access to your tax information, including refund status and payment options.

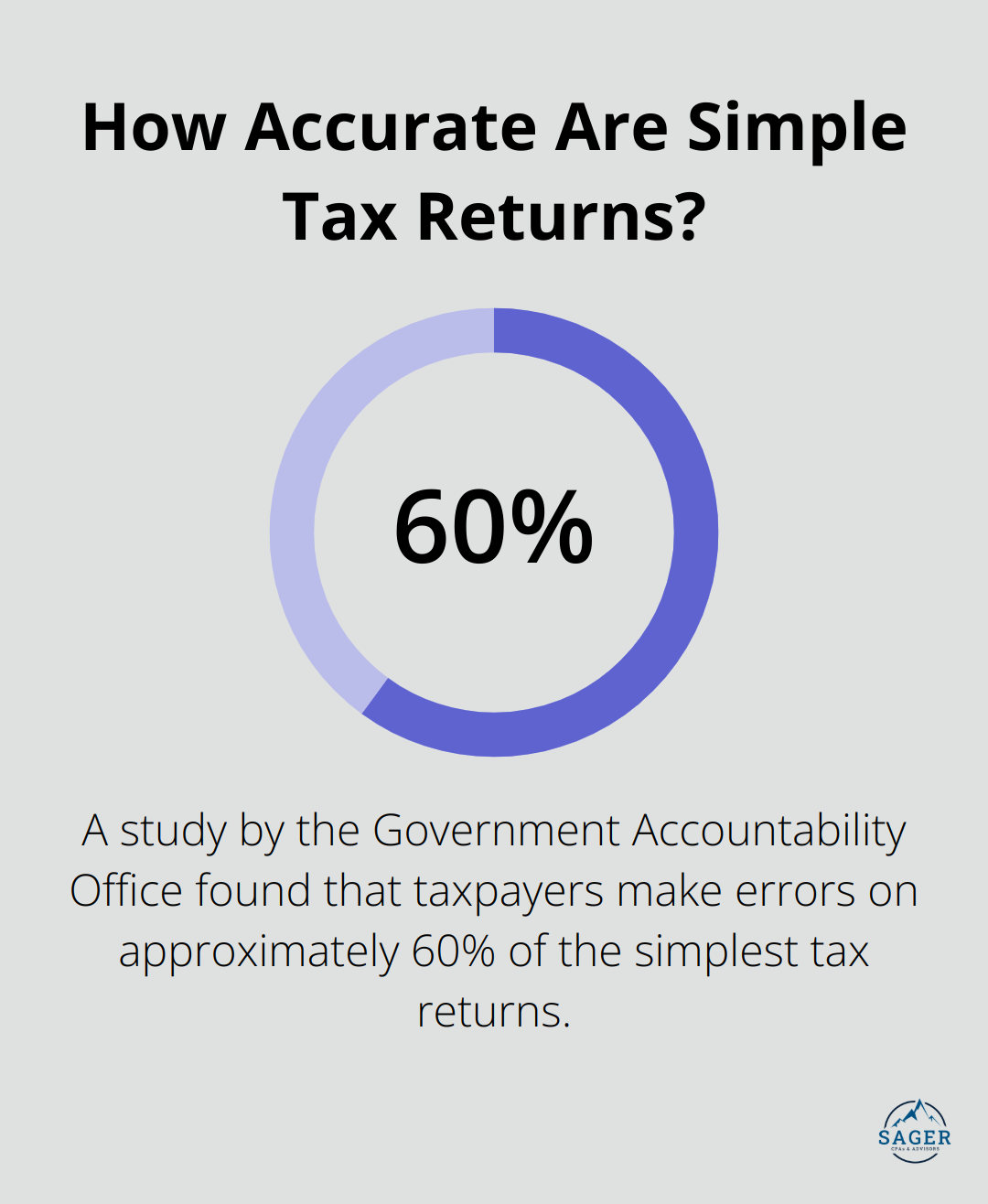

Software is powerful, but it can’t replace the nuanced understanding of a seasoned tax professional. The tax code is complex and ever-changing. A study by the Government Accountability Office found that taxpayers make errors on approximately 60% of the simplest tax returns. Professional advisors can help streamline your tax processes, assist in figuring out tax liability, identify potential savings, and ensure compliance with tax laws.

A skilled advisor might recognize that your business qualifies for the Research and Development Tax Credit, potentially saving you thousands of dollars. They can also provide strategic advice on timing major financial decisions (selling investments or purchasing business equipment) to optimize your tax position.

The IRS website offers free tax information. Publications like Circular 230 provide detailed guidance on tax practice standards. The Interactive Tax Assistant on the IRS site can answer many specific tax questions without the need for a phone call.

For business owners, the Small Business and Self-Employed Tax Center provides targeted resources, including industry-specific tax guides. These guides can help you understand the unique tax considerations in fields like construction, healthcare, or retail.

The IRS offers email subscriptions for tax tips and news updates, ensuring you’re always aware of important deadlines and changes that could affect your tax strategy.

Tax laws and regulations change frequently. Attending workshops, webinars, and continuing education courses can help you stay informed about these changes. Many professional organizations (such as the American Institute of CPAs) offer regular educational opportunities.

These educational resources not only keep you updated on tax laws but also provide networking opportunities with other professionals. This network can be invaluable for sharing best practices and gaining insights into effective tax strategies.

Proactive tax planning empowers individuals and businesses to take control of their financial future. You can reduce your tax burden, increase financial stability, and make informed decisions about your money through year-round tax management. The strategies we discussed will lead to substantial savings and long-term financial growth.

Tax planning tools and resources are more accessible than ever. From sophisticated software to professional advisors, you have many options to support your efforts. The most important step is to start implementing these strategies now, rather than waiting until tax season approaches.

At Sager CPA, we understand the complexities of tax planning and the importance of a proactive approach. Our team of experts will help you navigate the intricacies of the tax code and develop a personalized strategy that aligns with your financial goals. We offer comprehensive tax planning services designed to minimize your tax liability and maximize your financial potential.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.