Tax planning for LLCs can be a complex but rewarding process. At Sager CPA, we’ve seen firsthand how proper tax strategies can significantly impact an LLC’s bottom line.

This guide will walk you through essential techniques to optimize your LLC’s tax position, from understanding pass-through taxation to implementing advanced planning methods. We’ll explore practical ways to maximize deductions, time your income and expenses, and structure your entity for optimal tax benefits.

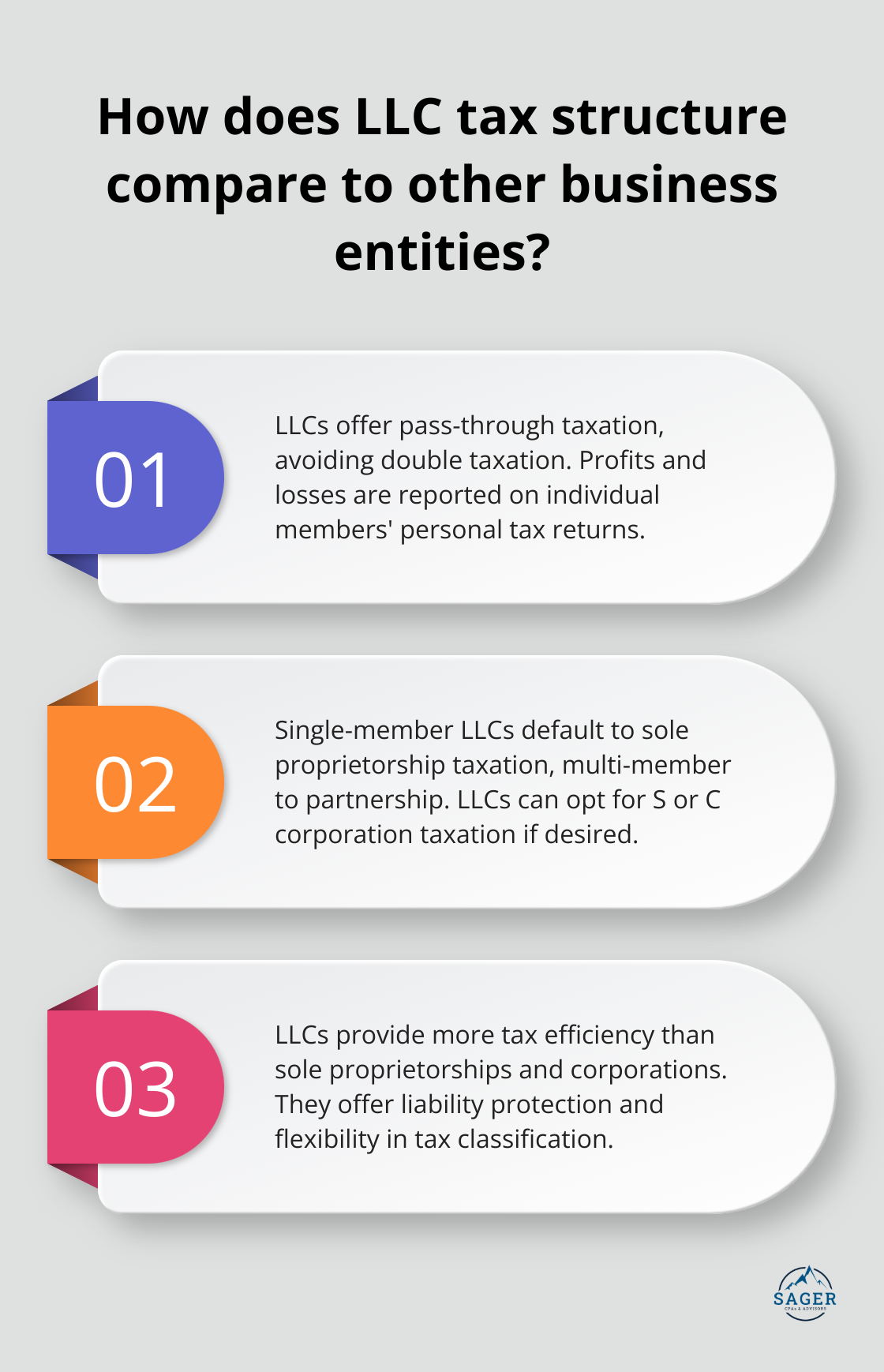

LLCs (Limited Liability Companies) offer a unique tax structure that combines flexibility and protection. The cornerstone of this structure is pass-through taxation. In this system, the LLC doesn’t pay federal income taxes. Instead, profits and losses “pass through” to the individual members’ personal tax returns. You’ll report your share of the LLC’s income on your individual Form 1040. For instance, if your LLC earns $100,000 in a year and you own 50%, you’ll report $50,000 of business income on your personal tax return.

LLCs avoid double taxation, which is a significant advantage. Unlike C corporations, where profits face taxation at both corporate and individual levels, LLC profits only incur taxes once. This can lead to substantial tax savings. LLCs also provide flexibility in tax classification. Single-member LLCs default to sole proprietorship taxation, while multi-member LLCs default to partnership taxation. However, LLCs can opt for S corporation or C corporation taxation if it suits their situation better.

LLCs often outperform other business structures in tax efficiency. Sole proprietorships offer similar pass-through taxation but lack the liability protection of an LLC. S corporations provide pass-through taxation but come with stricter operational requirements and ownership restrictions. Unlike sole proprietors, partnerships, and LLCs, corporations pay income tax on their profits, which can result in double taxation in some cases.

The choice of business structure can significantly impact your tax situation. Your specific circumstances, including income level, growth plans, and personal financial goals, all influence the best tax structure for your business. While LLCs offer many benefits, they’re not a universal solution. A tax professional can help you navigate these complexities and make an informed decision for your financial future.

The right business structure can lead to substantial tax savings and simplified compliance. For example, a business owner might save thousands in taxes in their first year after switching from a sole proprietorship to an LLC taxed as an S corporation. (This example illustrates the potential benefits, but individual results may vary.)

As we move forward, we’ll explore effective tax planning strategies that can help you maximize the benefits of your LLC’s tax structure. These strategies will show you how to optimize deductions, time your income and expenses, and utilize retirement plans for additional tax savings.

LLCs should take full advantage of allowable deductions. Track all business expenses meticulously. Common deductions include office rent, utilities, equipment, and travel costs. Don’t overlook less obvious deductions like professional development expenses or the home office deduction if you work from home.

Software tools can help you capture expenses in real-time. Use apps like Expensify or QuickBooks to snap photos of receipts and automatically categorize expenses. This ensures you don’t miss deductions and simplifies tax preparation.

Timing plays a key role in tax planning. If you expect to be in a lower tax bracket next year, defer income to the following year. This could involve delaying billing for services or postponing the sale of appreciated assets. Conversely, if you anticipate being in a higher bracket, accelerate income into the current year.

For expenses, the reverse strategy applies. If you’re in a higher tax bracket this year, prepay some of next year’s expenses to increase your deductions. This might include paying for subscriptions, insurance premiums, or office supplies in advance.

Retirement plans offer dual benefits: tax savings now and financial security later. For small business owners, a Simplified Employee Pension (SEP) IRA can be particularly attractive. In 2025, you can contribute up to 25% of your net earnings from self-employment, or $70,000, whichever is less.

For even higher contribution limits, consider a Solo 401(k). This plan allows you to contribute as both an employer and an employee, potentially allowing for larger tax-deductible contributions compared to a SEP IRA.

The tax benefits of retirement contributions are twofold. You reduce your taxable income now, and the investments grow tax-deferred until withdrawal.

Hiring family members can be a smart tax move. If you hire your children, their wages become a tax-deductible business expense for you. Plus, if they’re under 18, you don’t have to withhold payroll taxes. Your child can earn up to the standard deduction amount ($13,850 in 2025) tax-free.

This strategy shifts income from your higher tax bracket to your child’s lower one. Just ensure the work is legitimate and the pay is reasonable for the tasks performed.

These strategies can significantly reduce your LLC’s tax liability. However, tax laws are complex and ever-changing. While these tips provide a starting point, consulting with a tax professional (like those at Sager CPA) is essential for developing a comprehensive, tailored tax strategy for your LLC. In the next section, we’ll explore advanced LLC tax planning techniques that can further optimize your tax position.

LLCs can optimize their tax position through strategic entity structuring. One effective method involves the creation of multiple entities within the business structure. For example, a holding company can own the LLC’s intellectual property. The operating LLC then pays royalties to the holding company, which may shift income to a lower-tax jurisdiction.

Another approach is the “C corp blocker” strategy. This involves the creation of a C corporation that owns a portion of the LLC. This structure can help retain earnings at the corporate level, where tax rates might be lower than individual rates.

(These structures require careful planning and expert guidance to ensure compliance with IRS regulations.)

LLCs operating in multiple states face additional tax complexities. Each state has unique rules for nexus (the connection that triggers tax obligations) and income allocation.

To minimize multi-state tax burdens, LLCs should consider establishing their primary office in a low-tax state. Wyoming, for instance, offers a business-friendly tax environment due to its low tax burden. However, genuine operations must exist in these states to claim them as a base.

A thorough review of sales and operations in each state can help avoid creating nexus in high-tax jurisdictions. This may involve restructuring activities to optimize the tax footprint.

The method of profit distribution from an LLC can significantly impact the overall tax bill. LLCs taxed as S corporations can potentially reduce self-employment taxes by taking a portion of earnings as distributions rather than salary.

The IRS mandates that the procedures for compensating yourself for your efforts in carrying on a trade or business will depend on the type of business structure you elect. The definition of reasonable varies by industry and role but should align with market rates for similar positions.

Strategic timing of distributions can also yield tax benefits. If tax rates are expected to change due to legislative shifts or personal income fluctuations, LLCs can adjust the timing of distributions accordingly.

LLCs should explore available tax credits to further reduce their tax liability. The Research and Development (R&D) tax credit, for example, can provide substantial savings for LLCs engaged in innovative activities.

(The Work Opportunity Tax Credit offers incentives for hiring individuals from certain target groups, potentially reducing an LLC’s tax burden while promoting workforce diversity.)

For LLCs with international operations, careful tax planning becomes even more critical. Strategies such as transfer pricing and the use of foreign tax credits can help minimize global tax liabilities.

Establishing subsidiaries in tax-friendly jurisdictions might offer advantages, but such structures must comply with complex international tax regulations.

Effective tax planning for LLCs requires careful consideration and strategic implementation. Understanding the unique tax structure of LLCs, maximizing deductions, and utilizing retirement plans can significantly reduce tax burdens. Advanced strategies such as entity structuring and multi-state tax optimization further enhance potential tax savings.

The strategies outlined in this guide serve as a starting point, but their effectiveness depends on specific business situations and financial goals. What works for one LLC may not be optimal for another, which underscores the importance of personalized advice. To truly optimize your LLC’s tax position, you should partner with experienced professionals.

At Sager CPA, we specialize in providing tailored financial management and tax planning services for businesses and individuals. Our team can help you develop a comprehensive tax strategy that aligns with your business objectives and maximizes your financial potential. (Tax planning for LLCs is an ongoing process that requires regular reviews and adjustments to leverage the most current and beneficial tax-saving opportunities.)

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.