At Sager CPA, we often encounter clients who are unsure about the difference between tax planning and tax avoidance. While both aim to reduce tax liability, they are not the same.

Understanding this distinction is vital for individuals and businesses looking to manage their finances responsibly. In this post, we’ll explore the key differences between these two approaches and why it matters for your financial health.

Tax planning is a strategic approach to manage finances and minimize tax liability within legal boundaries. It requires a thorough understanding of tax laws and regulations, as well as the ability to anticipate future changes in tax policy. Effective tax planning is proactive, not reactive. It involves making informed choices throughout the year, rather than searching for deductions at the last minute during tax season.

One popular tax planning method maximizes contributions to retirement accounts. For example, contributing to a 401(k) or IRA can lower your taxable income for the year. The IRS allows contributions up to $22,500 to a 401(k) if you’re under 50, and $30,000 if you’re 50 or older (as of 2023).

Another effective strategy involves timing income and expenses. Self-employed individuals or business owners might consider deferring income to the next tax year or accelerating expenses into the current year to lower taxable income. However, it’s important to ensure these decisions align with overall financial goals.

Understanding and utilizing available tax credits and deductions is a key aspect of tax planning. The Child Tax Credit, for instance, can provide significant savings for families. As of 2023, this credit is worth up to $2,000 per qualifying child under 17.

Charitable donations can also serve as an effective tax planning tool. Not only do they support causes you care about, but they can also reduce your taxable income. (Keep in mind that you’ll need to itemize your deductions to claim charitable contributions.)

While some tax planning strategies are straightforward, others can be complex and require professional expertise. Working with a qualified tax professional can help you navigate the intricacies of tax law and develop a comprehensive tax planning strategy tailored to your specific situation.

Tax planning is an ongoing process that requires regular review and adjustment. As your financial situation changes and tax laws evolve, your tax planning strategies should adapt accordingly. A proactive approach to tax planning can potentially save significant amounts of money and set you up for long-term financial success.

Now that we’ve explored the concept of tax planning, let’s turn our attention to a related but distinct concept: tax avoidance. Understanding the differences between these two approaches is critical for making informed financial decisions.

Tax avoidance occupies a complex space in the world of finance and taxation. Unlike tax planning, which operates within clear legal boundaries, tax avoidance often exploits loopholes or ambiguities in tax laws to reduce tax liabilities. While technically legal, tax avoidance strategies can raise ethical concerns and attract scrutiny from tax authorities.

Tax avoidance strategies often push the boundaries of what’s considered acceptable under tax laws. These methods might include complex offshore arrangements, aggressive interpretations of tax codes, or artificial transactions designed solely to reduce tax burdens. For instance, some multinational corporations use transfer pricing manipulations to shift profits to low-tax jurisdictions (a practice that, while often legal, has faced increasing criticism and regulatory pushback).

Engaging in aggressive tax avoidance can lead to significant risks. The Internal Revenue Service (IRS) has become increasingly adept at identifying and challenging questionable tax practices. The total amount of enforced and other late payments is projected to be $90 billion in TY 2022, with about 75 percent of the projected total, or $68 billion, coming from various enforcement efforts.

Financial penalties for disallowed tax avoidance schemes can be severe. In some cases, taxpayers may face fines of up to 75% of the underpaid tax amount, plus interest. Moreover, the reputational damage from being associated with aggressive tax avoidance can be long-lasting and detrimental to businesses and individuals alike.

The complexities and risks associated with tax avoidance make professional advice essential. Ethical tax practices that align with both the letter and spirit of tax laws should be emphasized. A focus on legitimate tax planning strategies can minimize risk while optimizing financial outcomes for taxpayers.

It’s important to note that tax avoidance differs from tax evasion. While avoidance involves legal (albeit sometimes questionable) methods to reduce tax liability, evasion is illegal and involves deliberately misrepresenting or concealing information to escape tax payments. The consequences of tax evasion can include hefty fines, penalties, and even imprisonment (as outlined by the Income Tax Department).

As we move forward, it’s essential to understand the key differences between tax planning and tax avoidance. These distinctions will help you make informed decisions about your financial strategies and ensure compliance with tax regulations.

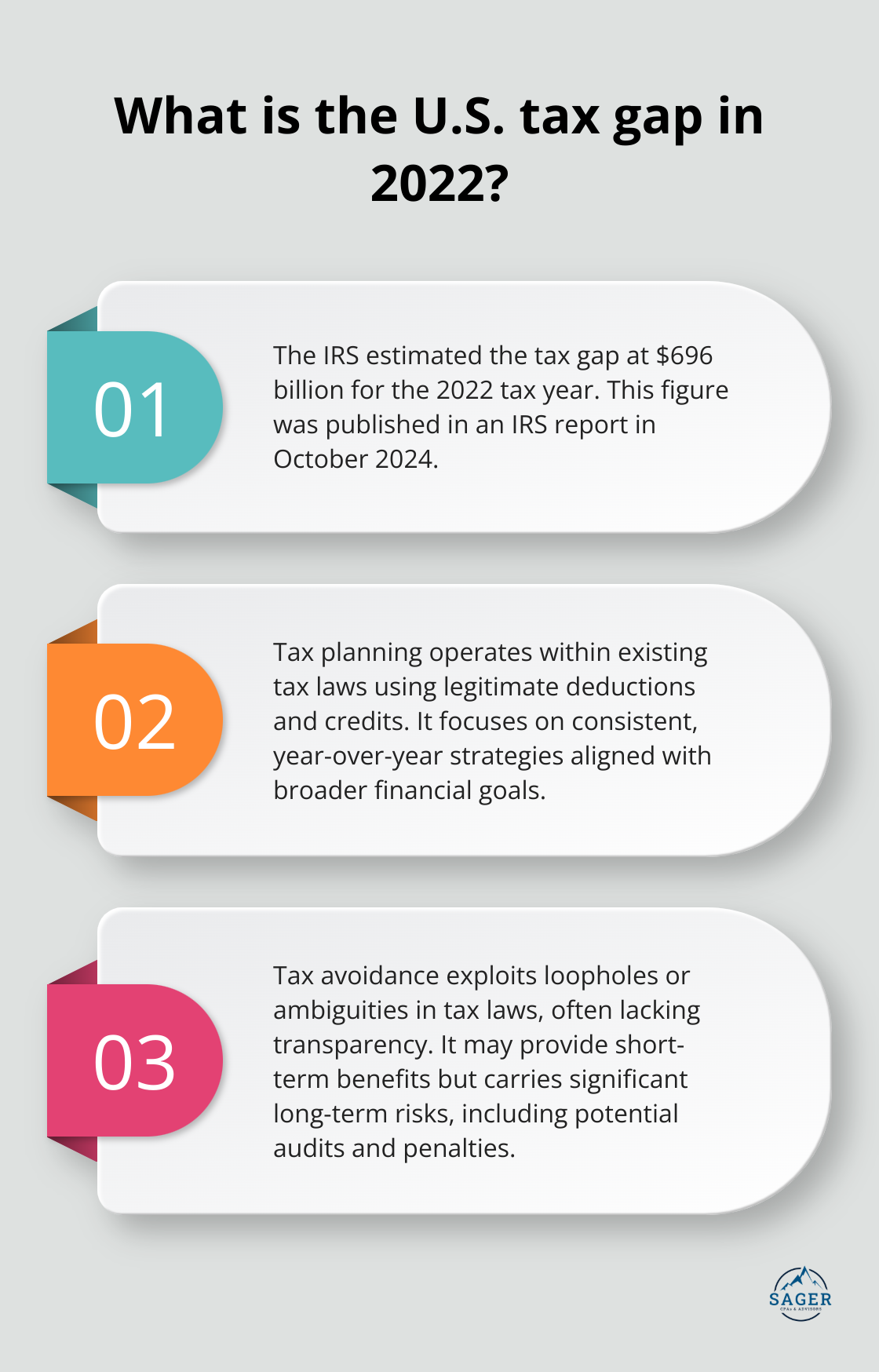

Tax planning operates within the framework of existing tax laws. It uses legitimate deductions, credits, and strategies to minimize tax burdens. For example, taxpayers maximize contributions to retirement accounts or time income and expenses as common tax planning methods. These strategies are not only legal but often encouraged by tax authorities to promote specific economic behaviors.

Tax avoidance exploits loopholes or ambiguities in tax laws. While technically legal, these strategies may contradict the spirit of the law. The IRS and other tax authorities scrutinize such practices closely. In a report published in October 2024, the IRS estimated the tax gap at $696 billion for the 2022 tax year.

Transparency marks effective tax planning. All transactions and strategies are fully disclosed to tax authorities. This openness minimizes the risk of audits and penalties. Tax avoidance schemes often lack transparency. Complex structures or offshore arrangements may obscure the true nature of transactions, increasing the risk of scrutiny and potential legal challenges.

Tax planning focuses on consistent, year-over-year strategies that align with broader financial goals. These methods are less likely to be affected by changes in tax laws or increased enforcement. Tax avoidance schemes (particularly aggressive ones) may provide short-term benefits but carry significant long-term risks. If tax laws change or loopholes close, the financial consequences can be severe.

Tax planning minimizes risks associated with tax compliance. It provides a clear path for individuals and businesses to meet their tax obligations while optimizing their financial position. Tax avoidance, on the other hand, often involves higher levels of risk. The potential for audits, penalties, and reputational damage increases with more aggressive tax avoidance strategies.

Professional advice plays a crucial role in both tax planning and avoidance, but the nature of this guidance differs. In tax planning, professionals focus on understanding a client’s unique financial situation and develop strategies that comply with tax laws while optimizing financial outcomes. This approach ensures that clients can confidently navigate tax season without fear of future repercussions.

For tax avoidance, some professionals may push the boundaries of what’s legally permissible. While this might result in short-term tax savings, it can expose clients to significant risks (including potential legal consequences and financial penalties).

Transform Your Financial Future by working with experienced professionals who can help you navigate the complexities of tax planning and maximize your savings within legal boundaries.

The difference between tax planning and tax avoidance impacts financial decisions significantly. Tax planning operates within legal boundaries and aligns with ethical practices, offering long-term benefits and minimizing risks. It optimizes financial positions while maintaining transparency with tax authorities, reducing the likelihood of audits and fostering financial confidence.

Effective tax planning frees up resources for growth, innovation, and job creation in businesses. It allows companies to reinvest in operations, expand their workforce, and contribute positively to the economy. Individuals can use tax planning to build wealth, save for retirement, and achieve financial goals more efficiently.

Navigating complex tax laws requires expertise. Sager CPA provides expert financial management and tax planning services tailored to unique needs (of individuals and businesses). Our team offers precise accounting, strategic advisory services, and comprehensive tax planning to help reduce liabilities and enhance financial clarity.

Privacy Policy | Terms and Conditions | Powered by Cajabra

At Sager CPAs & Advisors, we understand that you want a partner and an advocate who will provide you with proactive solutions and ideas.

The problem is you may feel uncertain, overwhelmed, or disorganized about the future of your business or wealth accumulation.

We believe that even the most successful business owners can benefit from professional financial advice and guidance, and everyone deserves to understand their financial situation.

Understanding finances and running a successful business takes time, education, and sometimes the help of professionals. It’s okay not to know everything from the start.

This is why we are passionate about taking time with our clients year round to listen, work through solutions, and provide proactive guidance so that you feel heard, valued, and understood by a team of experts who are invested in your success.

Here’s how we do it:

Schedule a consultation today. And, in the meantime, download our free guide, “5 Conversations You Should Be Having With Your CPA” to understand how tax planning and business strategy both save and make you money.